| Blogs > looklook > Views from the Balcony |

|

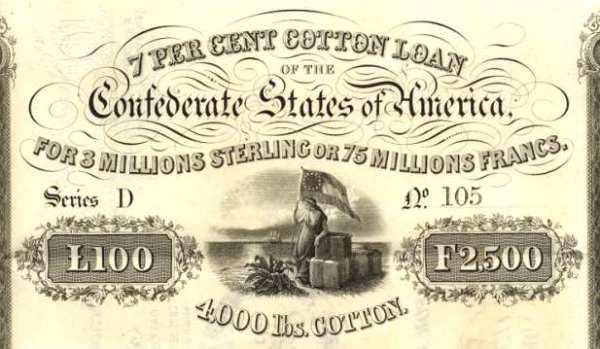

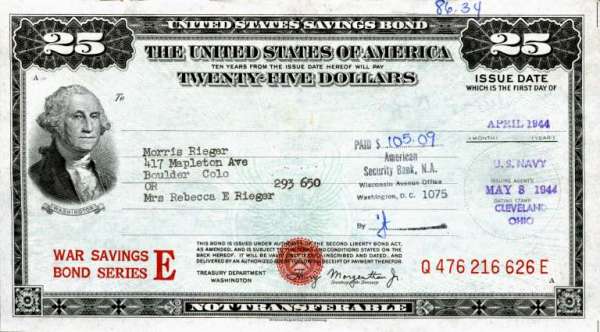

Bond And Bond Market. Dear AEG, Thank you so much AEG for your latest e mail telling me that you have since retired from active teaching job. I could not imagine what made you ask me to tell you everything that I know about bond and bond market. Anyway, what ever the cause may be, I take this opportunity to let you know the salient features of a bond here under that may provide you the desired information that you have sought to know from me!. At the same time, I must tell you to discuss the matter threadbare with an expert if you intend to buy bonds issued either by a large corporate body or by the government. You must not buy bonds on the basis of information given here under which is obviously academic in nature! I trust that you know what a bond is though you may not know how a bond market operates. Yet, I feel like telling you what is actually meant by the term Bonds? The answer is not a complicated one. Bonds are basically nothing but loans. You will simply become a lender to an institution when you buy a bond issued by this particular institution for raising money to meet its financial requirements from time to time. Like other loans, the lender earns interest on it until the bond reaches maturity. The interest is usually paid at specific intervals in the shape of dividend which is commonly known as coupon. Hope,it is now clear to you that a bond is a loan that pays interest for a fixed period of time. What happens when a bond matures at end of the term? Nothing much except the principal amount of the bond is repaid in full to the lender or the owner of the bond as long as the institution does not go bankrupt! Bonds are also known as Fixed-Income Securities in the financial markets as because the rate at which the interest is payable and the amount of each payment is fixed when bonds are offered for sale. Therefore, some investors prefer to buy bonds as it is a less risky investment in comparison to other forms of investments where returns are not fixed. Needless to mention here that bond’s interest rate has to be competitive for obvious reason. It may also be noted here that “unlike stockholders, who have equity, or part ownership, in a company, bondholders are creditors.” A bond is an IOU. It is a record of the money that a bondholder lends and the terms on which it will be repaid. One can buy bonds issued by Corporations, by the Government Treasury, and by local government agencies etc. Bonds that are issued by corporate bodies are known as corporate Bonds. They issue such bonds to raise capital to pay for expansion, modernization, to cover operating expenses, to finance corporate takeovers or other changes in management structures. The Treasury bonds are those that are issued by the Government to pay for a wide range of Government activities and also to pay off the national debt. Municipal bonds are issued by various local government agencies to pay for a wide variety of public projects and also to supplement their operating budgets. We know that corporate bonds carry a higher degree of risk as well as return. Government bonds, typically offer a modest return with low risk. AEG, as a new would be investor, you must know, what are the forces that govern the performance of bonds and bond funds: interest rate sensitivity and credit risk for the safety of your hard earned money! Until you could learn everything in this respect, it will not wise for you to go for such investment if you have decided to do so. Perhaps, you have studied carefully what have been stated in the foregoing paragraphs. If you are still interested to learn more about Bond and other important things related to it, then drop me few lines. To be continued on receipt of favorable feedback:           |

|||

|

Thank you so much for your good wishes, Cactus Annie. You were always nice to me during the year 2015. I wish you all the best for the upcoming holidays and the new year, and hope you will spend a magical time with your loved ones and I also hope that all your dreams come true In2016.

| ||

|

Looklook MBN, thank you so much for this informative blog. I've read it with keen interest and it has really widened my scope. I wasn't so aware of all those sort of Bonds as I've never dealt with them. Thank you again for sharing this info with us. I wish you well, happy and cheerful during these festive seasons. My kind regards to you MBN. Lisa.

| ||

|

Delighted to read from you here on my blog your considerate opinion on the subject. I appreciate. Hope,you are now fully prepared to celebrate Christmas with your family and friends. Enjoy the festivities with joy and happiness. Have happy holidays too. warm regards,MLLD. look

|

×

×